Many believe it’s impossible to bounce back after credit damage, but that’s a myth. With the right steps and persistence, anyone can rebuild their credit. Here, we’ll cover five actionable tips to help you improve your credit score, boost financial stability, and set yourself up for a brighter financial future.

Strengthen Your Financial Knowledge

- “Master Your Money to Master Your Credit”

- Developing financial literacy is the first step toward strong credit health. Understand how your finances impact your credit score and why timely payments are crucial.

- Actionable Tips:

- Read books and attend workshops on budgeting and personal finance.

- Use apps to track your expenses and stay on top of bills.

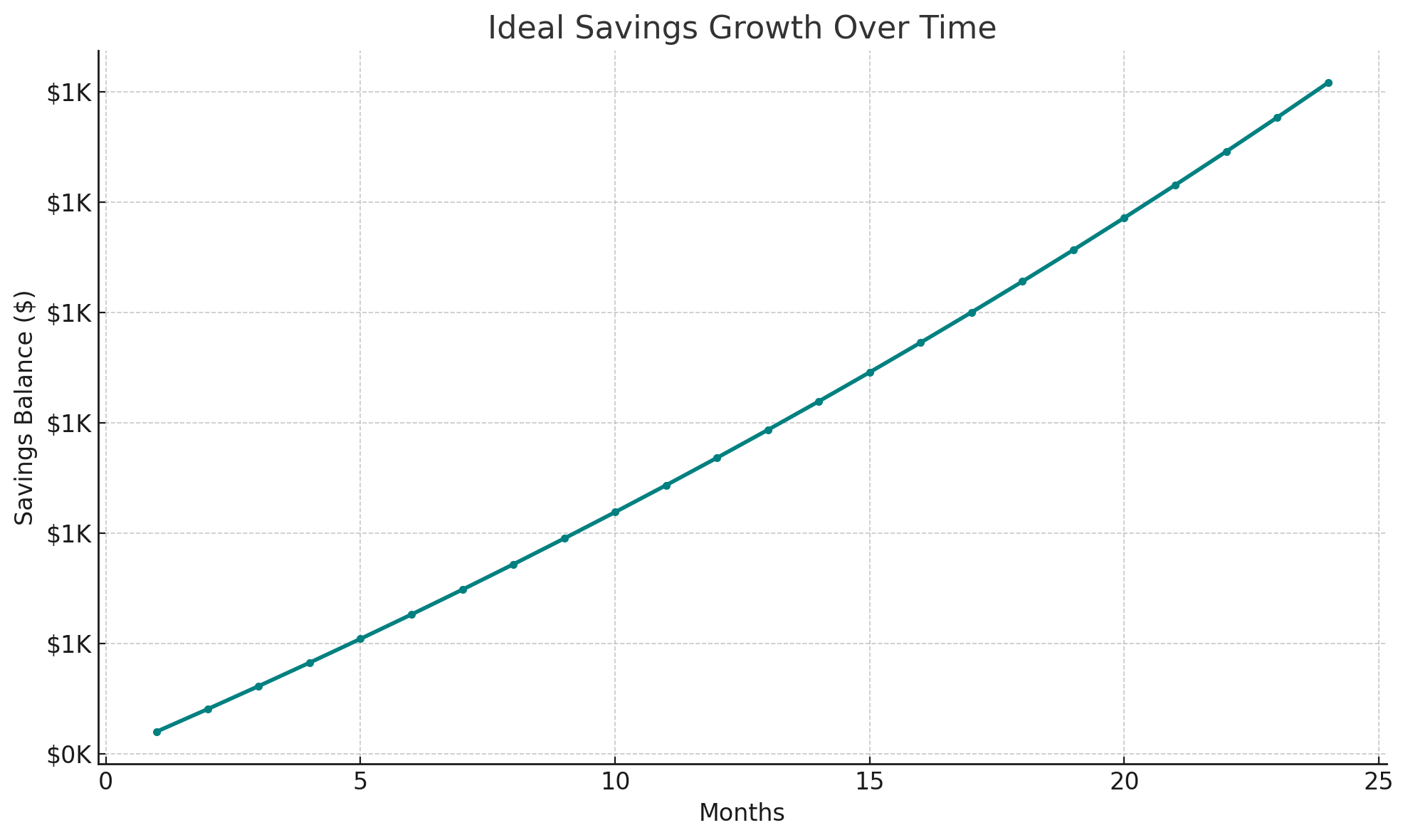

Build Strong Savings and Income History

- “Demonstrate Financial Discipline to Lenders”

- Lenders consider your savings, income, and job stability when evaluating loan applications. Strong financial habits increase your reliability and, over time, help you build credit.

- Actionable Tips:

- Keep at least three to six months of expenses in savings.

- Show consistency by staying with one employer or within the same field.

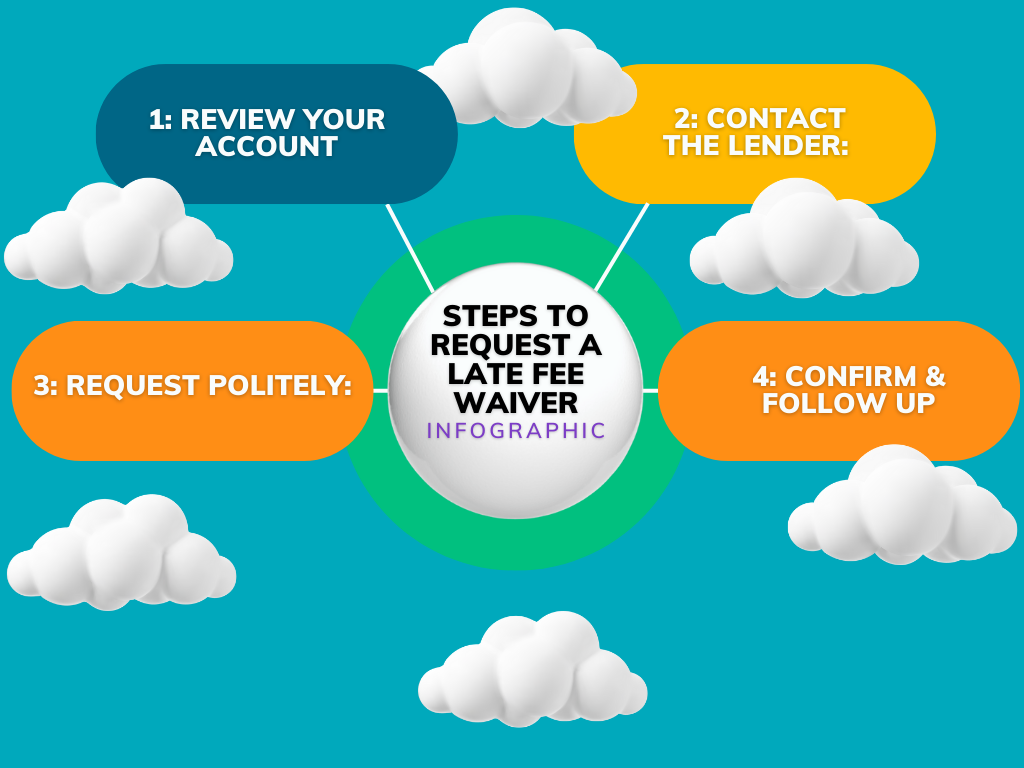

Request Courtesy Waivers for Late Fees

- “Minimize the Impact of Late Payments”

- If you’ve made a late payment, ask your lender to waive the fee as a goodwill gesture. This can keep more funds for paying down debt, which helps improve your score.

- Actionable Tips:

- Check your account to see if you qualify for fee waivers (typically once or twice a year).

- Direct the money saved toward reducing your credit card balances.

Organize Your Bill Payments Effectively

- “Staying Organized to Never Miss a Payment”

- Organization is key to keeping up with your bills. Late payments can hurt your credit score, so use reminders, auto-pay, and a system to track due dates.

- Actionable Tips:

- Use a file cabinet or digital folder for storing bills and financial documents.

- Set up auto-pay and email reminders to prevent missed payments.

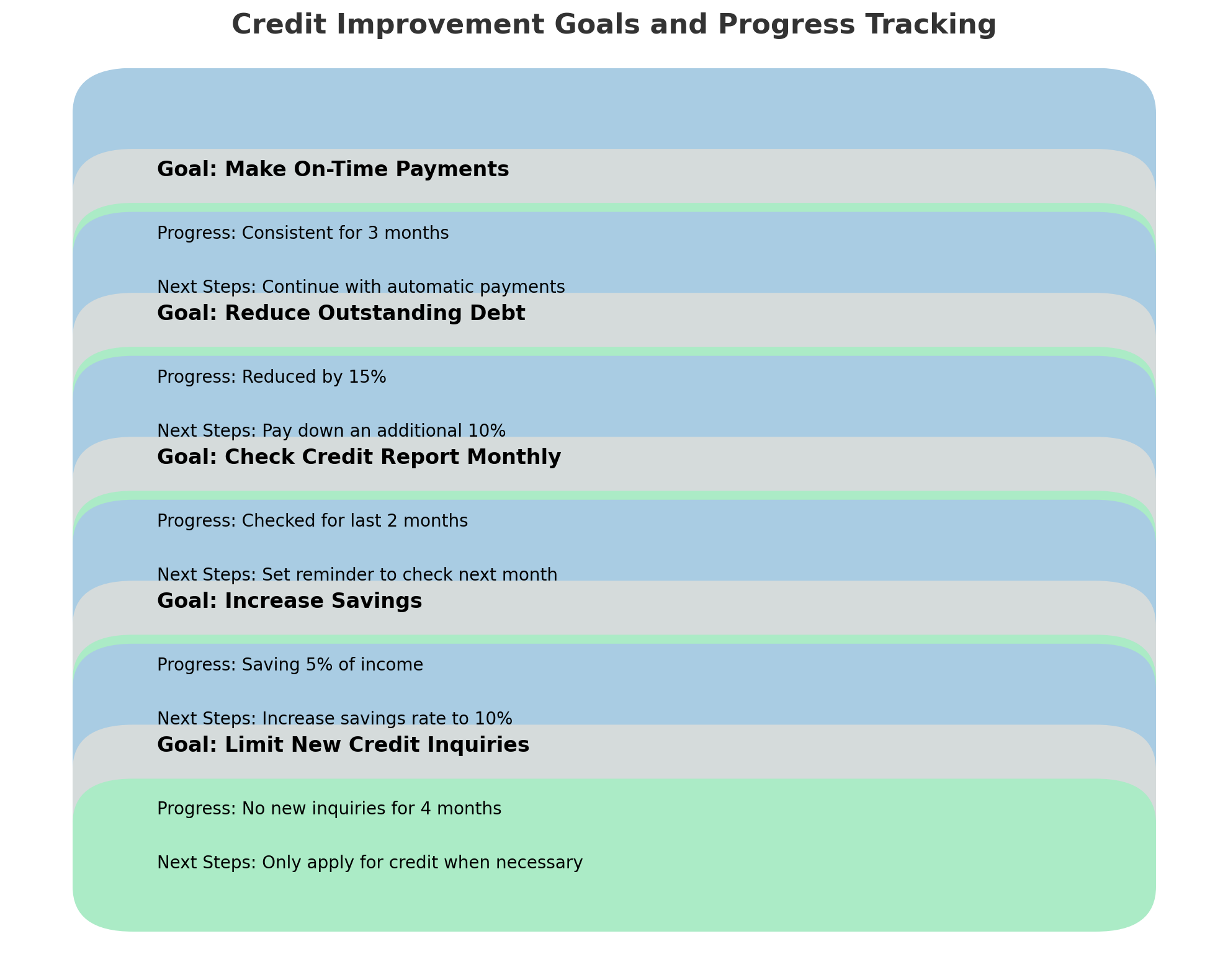

Set Goals and Track Your Progress

- “Track Your Credit Journey with Realistic Milestones”

- Setting goals helps you stay motivated and focused on credit improvement. Track your progress, set milestones, and make adjustments as you go.

- Actionable Tips:

- Create a credit improvement checklist to track letters, payments, and credit report changes.

- Set up a monthly schedule to check your credit score.

- Visual Suggestion: Goal-setting chart or checklist, with alt text: “Checklist showing credit improvement goals and progress tracking.”

Ready to take control of your credit journey? Download our free guide for even more strategies to improve your credit score and build financial stability!

Improving your credit doesn’t have to be overwhelming. By following these steps, organizing your finances, and staying proactive, you’ll be well on your way to a healthier credit score. Remember, the journey may be gradual, but every small action counts!